Teamed up to adapt several future-focused stories across the insurance industry into clickable presentations, presenting technological impact & disruption of the existing insurance ecosystem.

I worked with the creative director & support designer — produce 22 interactive story presentations for client and customer testing.

Disrupting Uncertainty

To successfully translate scripts into credible interactive stories for presentation to their partners to help them further envision new products & processes for their customers and in addition to complete 20+ interactive displays to within project's budget & deadline.

The Approach

With a variety of scripts & journey maps generated during internal workshops, we evolved them further through research across the insurance customer/prospect, agent/broker, underwriters & technology lifecycles. These scripts outline scenarios from the ease of data entry between Agents & Underwriters, Process Automation, Lifestyle Rewards & more.

Key Insights

Story Telling: Easy to following & demonstrating key insights & technologies benefits.

Presentable to a large audience & easily shared.

Using familiar personas, processes & information visualisations with embedded interactive artefacts.

Communicating Design

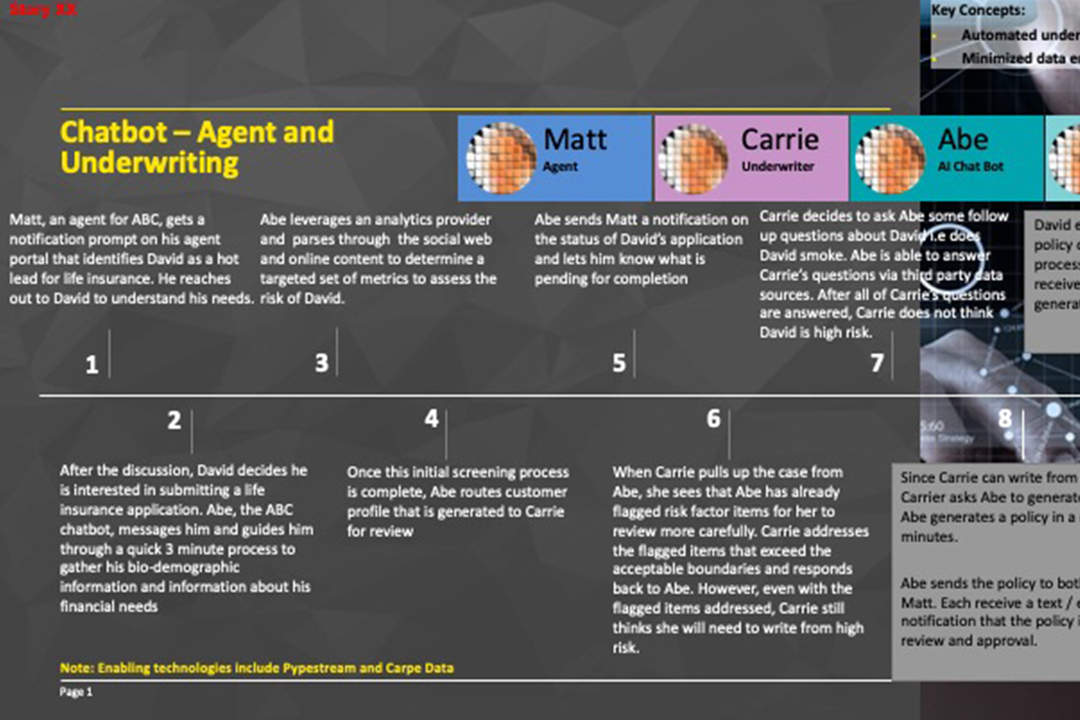

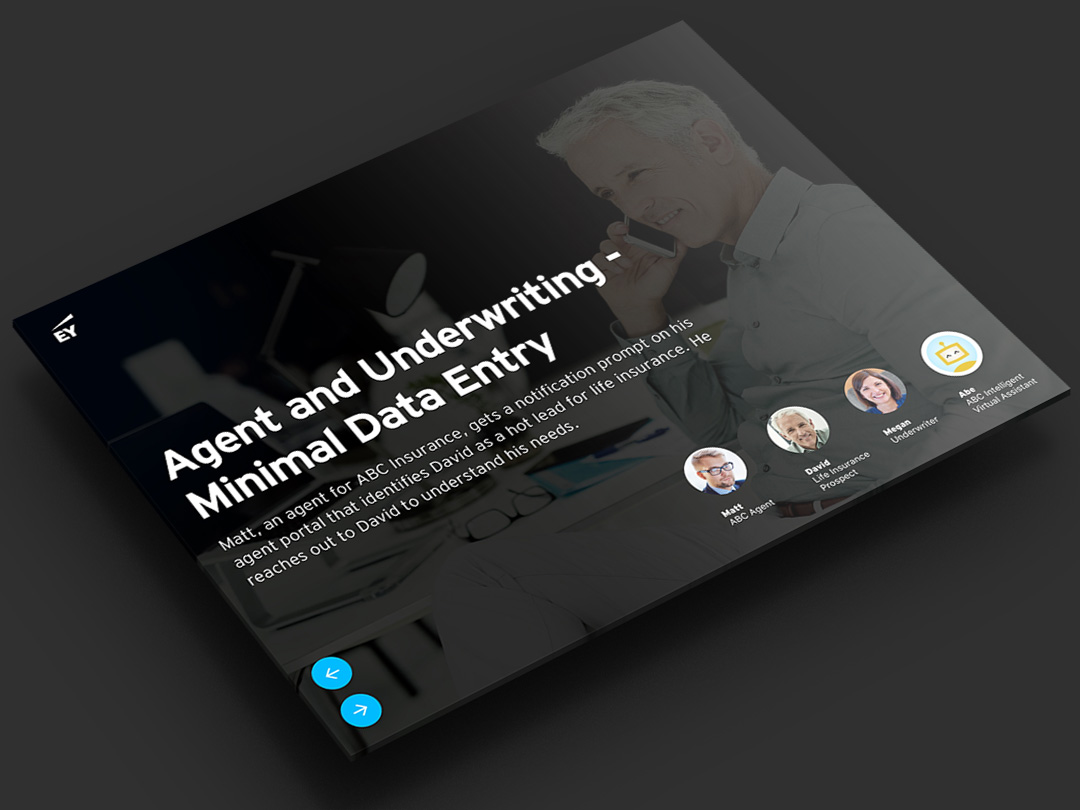

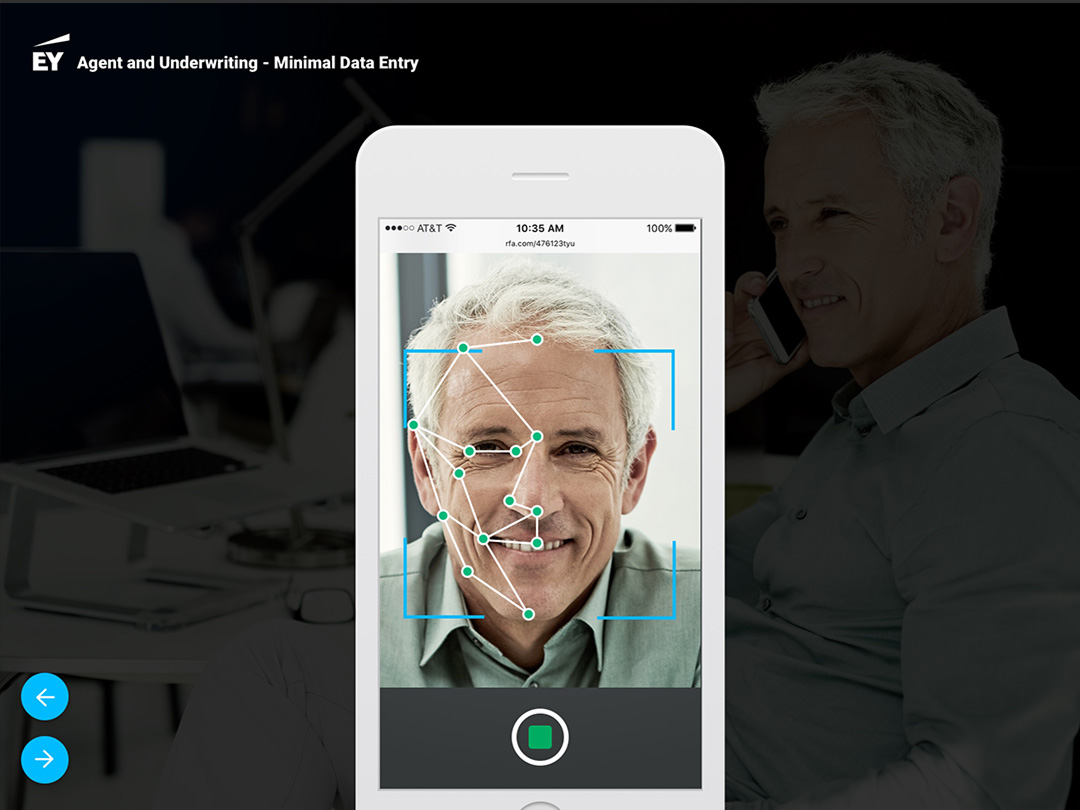

In the Agent & Underwriter - Minimal Input story, we focused on using AI, Chatbots & Facial recognition to reduce some of the input load for all personas & streamline application processes.

An AI will assist customers through 'Facial Recognition' for easy identification & validation of application while helping the Agent through automating the sourcing of a compatible Underwriter that can meet the needs of their customers.

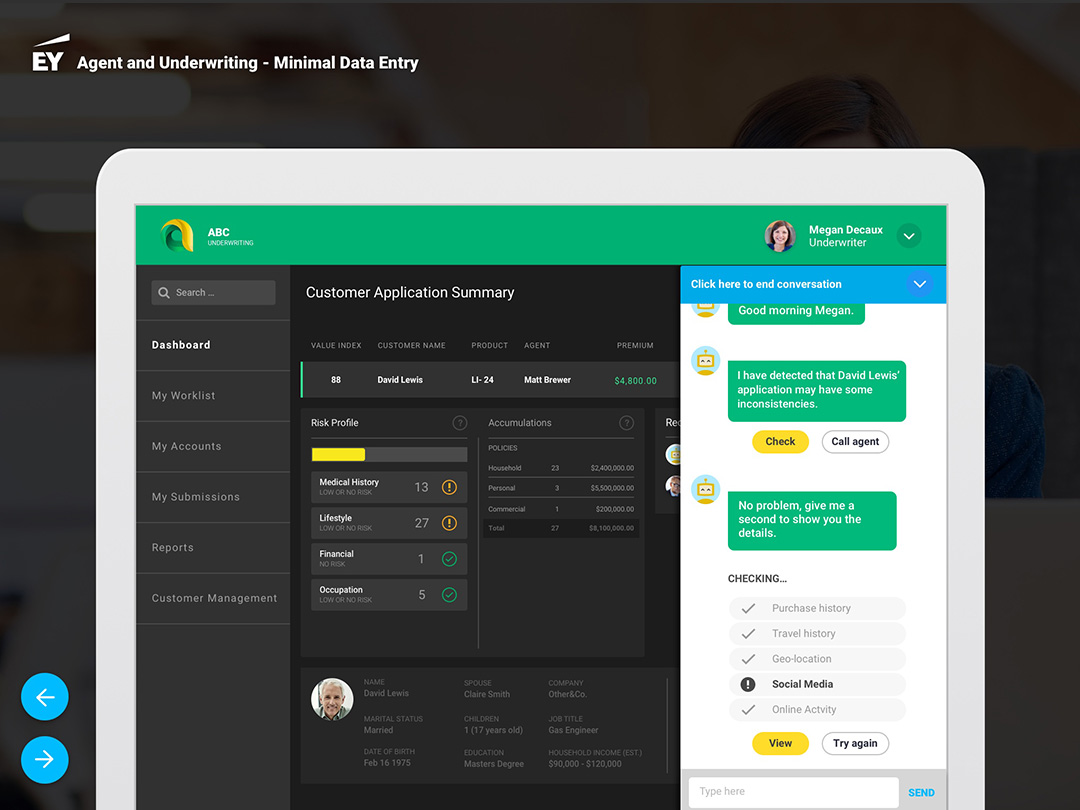

Combining AI & Chatbot interactions to assess the applicant's data across their various data touchpoints for the final decision.

Presentation

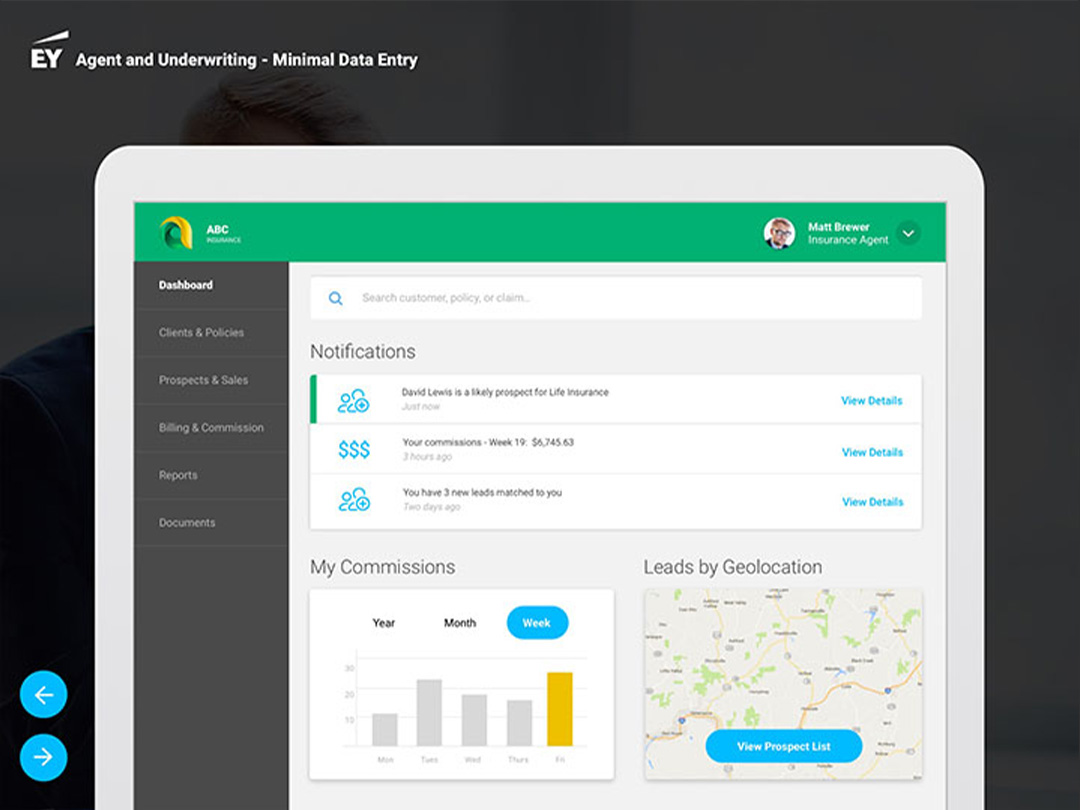

After developing storyboards & reviews by SMEs, we delivered the journeys as fully interactive presentations...

After speaking with their Agent, the consumer receives a text message linking them to a mobile application which will capture key data points to allow for submission with secure Facial Recognition.

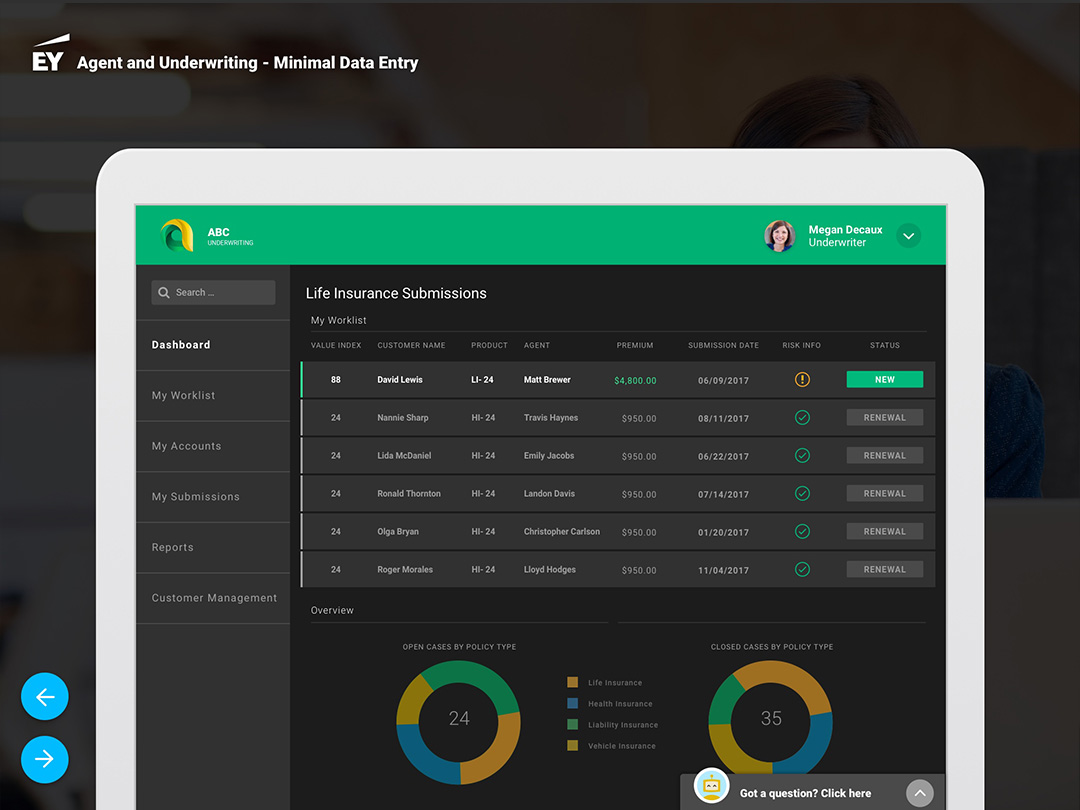

The Agent receives a notification of their client's applications matching with an Underwriter who'll receive an equivalent notice for them to start the assessment process with assistance from an AI Chatbot.

After Customer submits their application an AI compiles further information from broader sources associated with the customer such as Social Media...